smart card based electronic payment system A vast array of electronic payment systems have been (and are being) developed around the world. These are either smartcard systems, where the value is stored on a chip on a multipurpose card, or software systems where the value is stored as electronic tokens in the memory of the computer. The device comes with a 4GB microSDHC card for data storage and a built-in NFC reader for downloading games, apps, and content. It supports both local and online multiplayer gameplay. The New 2DS XL can record 3D videos, take 2D .I had the NES one from a few years ago that didn't come with the functionality, so I was pretty much in the same situation as you. I ended up just buying the new Samus 3DS XL with the built in amiibo reader; so I'd recommend doing that if you don't mind spending the money for a new .

0 · what constitutes a smart card

1 · smart cards used at banks

2 · smart card manufacturers

3 · smart card in banking

4 · smart card identification

5 · overview of smart card

6 · memory based smart card

7 · different types of smart cards

An Android NFC app for reading, writing, analyzing, etc. MIFARE Classic RFID .

Electronic Payment System allows customers to pay for goods and services electronically without the use of cheques or cash. Businesses need a strong and secure electronic payment system in online dealings. Electronic . Electronic Payment System allows customers to pay for goods and services electronically without the use of cheques or cash. Businesses need a strong and secure electronic payment system in online dealings. Electronic Payment System is regulated in India by the RBI.As a National eID card, smart health card, residence permit, or electronic passport, smart card technology offers more robust identification and authentication tools for both authorities' and citizens' benefits.A smart card (SC), chip card, or integrated circuit card (ICC or IC card), is a card used to control access to a resource. It is typically a plastic credit card-sized card with an embedded integrated circuit (IC) chip. [1] . Many smart cards include a pattern of metal contacts to electrically connect to the internal chip.

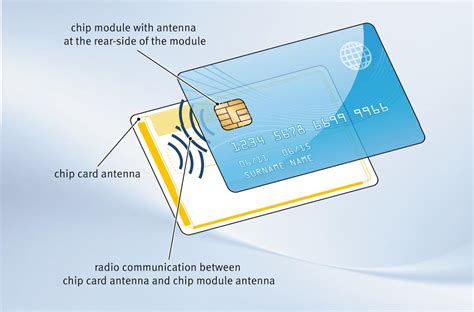

A vast array of electronic payment systems have been (and are being) developed around the world. These are either smartcard systems, where the value is stored on a chip on a multipurpose card, or software systems where the value is stored as electronic tokens in the memory of the computer.Used to make payments or to carry easily scannable information, smart cards are designed with an integrated chip built into the system. The chip is often embedded directly into the card and connects to a smart card reader either through wireless connectivity or physical contact.Smart cards capable of short-range wireless connectivity can be used for contactless payment systems. They can also be used as tokens for multifactor authentication ( MFA ). International standards and specifications cover smart card technology.Electronic payments are faster, more secure, and reduce the costs of traditional payment methods like cash and checks. Common electronic payment methods include credit cards, digital wallets, ACH transfers, and peer-to-peer apps. Security features like encryption, fraud detection, and compliance with regulations help protect electronic payment .

Ritesh Goyal. The document discusses electronic payment systems, their objectives, examples, types, and security services. It describes methods like e-cash, smart cards, and credit/debit cards. E-cash uses cryptographic algorithms to prevent double spending while preserving anonymity. Smart cards can process data and payments. The characteristics of smart cards make them particularly suitable for use in payment systems. The smart card is logically linked to a bank account, and after unilateral authentication of the card or mutual authentication of card and the background system, a previously entered sum is transferred. In this article, we analyze how smart card-based systems are used in mass transportation. Managers in mass transportation face the following questions: Do you develop your own electronic card payment system, do you wait for multifunctional cards that will be accepted across many industries to provide the functionality required in your market . Electronic Payment System allows customers to pay for goods and services electronically without the use of cheques or cash. Businesses need a strong and secure electronic payment system in online dealings. Electronic Payment System is regulated in India by the RBI.

As a National eID card, smart health card, residence permit, or electronic passport, smart card technology offers more robust identification and authentication tools for both authorities' and citizens' benefits.A smart card (SC), chip card, or integrated circuit card (ICC or IC card), is a card used to control access to a resource. It is typically a plastic credit card-sized card with an embedded integrated circuit (IC) chip. [1] . Many smart cards include a pattern of metal contacts to electrically connect to the internal chip.

A vast array of electronic payment systems have been (and are being) developed around the world. These are either smartcard systems, where the value is stored on a chip on a multipurpose card, or software systems where the value is stored as electronic tokens in the memory of the computer.Used to make payments or to carry easily scannable information, smart cards are designed with an integrated chip built into the system. The chip is often embedded directly into the card and connects to a smart card reader either through wireless connectivity or physical contact.Smart cards capable of short-range wireless connectivity can be used for contactless payment systems. They can also be used as tokens for multifactor authentication ( MFA ). International standards and specifications cover smart card technology.Electronic payments are faster, more secure, and reduce the costs of traditional payment methods like cash and checks. Common electronic payment methods include credit cards, digital wallets, ACH transfers, and peer-to-peer apps. Security features like encryption, fraud detection, and compliance with regulations help protect electronic payment .

Ritesh Goyal. The document discusses electronic payment systems, their objectives, examples, types, and security services. It describes methods like e-cash, smart cards, and credit/debit cards. E-cash uses cryptographic algorithms to prevent double spending while preserving anonymity. Smart cards can process data and payments. The characteristics of smart cards make them particularly suitable for use in payment systems. The smart card is logically linked to a bank account, and after unilateral authentication of the card or mutual authentication of card and the background system, a previously entered sum is transferred.

from where a passive rfid card gets its power

what constitutes a smart card

smart cards used at banks

smart card manufacturers

NFC is the technology in contactless cards, and the most common use of NFC technology in your smartphone is making easy payments with Samsung Pay. NFC can also be used to quickly connect with wireless devices and transfer .

smart card based electronic payment system|smart card identification