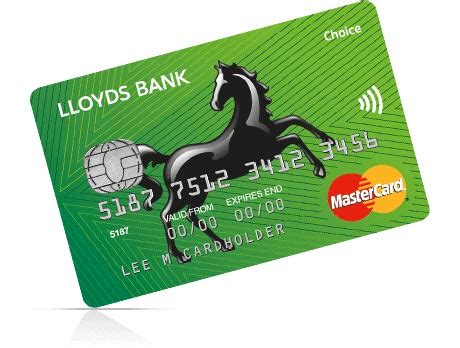

lloyds contactless card opt out Make everyday payments using Google Pay without the contactless card limit. It's safe, simple, and secure. Get benefits such as Everyday Offers on debit card and credit card purchases. . College basketball fans can also stream the game on Sling. . Florida. Florida State vs. Florida radio station. . at Auburn: 4:00 p.m. Feb. 11: at Mississippi St.

0 · Lloyds debit card contactless

1 · Lloyds credit card contactless payments

2 · Lloyds contactless sign in

3 · Lloyds contactless payment limit

4 · Lloyds contactless limit uk

5 · Lloyds contactless card

6 · Lloyds bank contactless sign in

7 · Lloyds bank contactless card protection

Texas A&M University is an engine of imagination, learning, discovery and innovation. Here, you'll learn essential career skills while discovering the rich values and time-honored traditions that make our university so special.

Opting out. Our cards are now contactless as standard. If you don’t want a contactless card, you can now use our app to freeze contactless transactions. The quickest way to stop contactless transactions is to freeze them in our app.Make everyday payments using Google Pay without the contactless card limit. It's safe, simple, and secure. Get benefits such as Everyday Offers on debit card and credit card purchases. .

If you report your card as lost or stolen or order a replacement card, your card will be cancelled straight away. Depending on the card you have ordered, a new one will be with you in 3-5 .Opting out. Our cards are now contactless as standard. If you don’t want a contactless card, you can now use our app to freeze contactless transactions. The quickest way to stop contactless transactions is to freeze them in our app.Make everyday payments using Google Pay without the contactless card limit. It's safe, simple, and secure. Get benefits such as Everyday Offers on debit card and credit card purchases. We may restrict the value or number of payments you can make using Google Pay.If you report your card as lost or stolen or order a replacement card, your card will be cancelled straight away. Depending on the card you have ordered, a new one will be with you in 3-5 working days.

Almost 9 in 10 card payments now contactless. 2 September 2022. Over 90% of consumers turn to contactless when eating out, with a similar number using the technology for their trip to the supermarket. Payment method has grown since pandemic, supported by .

Can I opt-out of having a contactless card? Most banks send their customers contactless debit or credit cards by default. If you don't want a contactless card, your provider may let you opt-out, although some big banks and credit card providers don't.

Can I opt out of contactless? Most banks we contacted said customers could turn off the contactless function in some way. Santander, Virgin Money, HSBC, Nationwide and First Direct said customers could request a non-contactless card. Lloyds Banking Group said customers request this and also turn off contactless using their app. The contactless card payment limit is rising from £45 to £100 on 15 October. But Bank of Scotland, Halifax, Lloyds and Starling will let you set your own limit, and others plan to do the same in future. Some providers will also let you turn off contactless completely. Here's what you need to know. Lloyds Bank, Halifax and Bank of Scotland customers will be able to set their own contactless card limits from next month when the higher £100 cap comes into force. From 15 October, the contactless card limit will rise from £45 to £100.

Lloyds Bank, Halifax and Bank of Scotland customers can choose their own debit or credit card limit of between £30 and £95 in £5 increments or turn contactless on and off using the tool within our mobile banking apps, via telephoneOn 15 October 2021 the contactless payment card spend limit increased from £45 to £100. Although there has been a positive response to the increase of the limit to £45 in 2020, this new £100 is.

Opting out. Our cards are now contactless as standard. If you don’t want a contactless card, you can now use our app to freeze contactless transactions. The quickest way to stop contactless transactions is to freeze them in our app.

Make everyday payments using Google Pay without the contactless card limit. It's safe, simple, and secure. Get benefits such as Everyday Offers on debit card and credit card purchases. We may restrict the value or number of payments you can make using Google Pay.If you report your card as lost or stolen or order a replacement card, your card will be cancelled straight away. Depending on the card you have ordered, a new one will be with you in 3-5 working days.

Almost 9 in 10 card payments now contactless. 2 September 2022. Over 90% of consumers turn to contactless when eating out, with a similar number using the technology for their trip to the supermarket. Payment method has grown since pandemic, supported by . Can I opt-out of having a contactless card? Most banks send their customers contactless debit or credit cards by default. If you don't want a contactless card, your provider may let you opt-out, although some big banks and credit card providers don't.

Can I opt out of contactless? Most banks we contacted said customers could turn off the contactless function in some way. Santander, Virgin Money, HSBC, Nationwide and First Direct said customers could request a non-contactless card. Lloyds Banking Group said customers request this and also turn off contactless using their app. The contactless card payment limit is rising from £45 to £100 on 15 October. But Bank of Scotland, Halifax, Lloyds and Starling will let you set your own limit, and others plan to do the same in future. Some providers will also let you turn off contactless completely. Here's what you need to know.

Lloyds debit card contactless

Lloyds Bank, Halifax and Bank of Scotland customers will be able to set their own contactless card limits from next month when the higher £100 cap comes into force. From 15 October, the contactless card limit will rise from £45 to £100. Lloyds Bank, Halifax and Bank of Scotland customers can choose their own debit or credit card limit of between £30 and £95 in £5 increments or turn contactless on and off using the tool within our mobile banking apps, via telephone

break on removal rfid tags

bluetooth rfid reader mobile phone

The No. 1 Georgia Bulldogs are headed to Auburn, AL, to take on the Auburn Tigers on September 30 at 3:30pm ET. You can listen to every snap live from Jordan-Hare Stadium on the SiriusXM App and in car radios with .

lloyds contactless card opt out|Lloyds credit card contactless payments